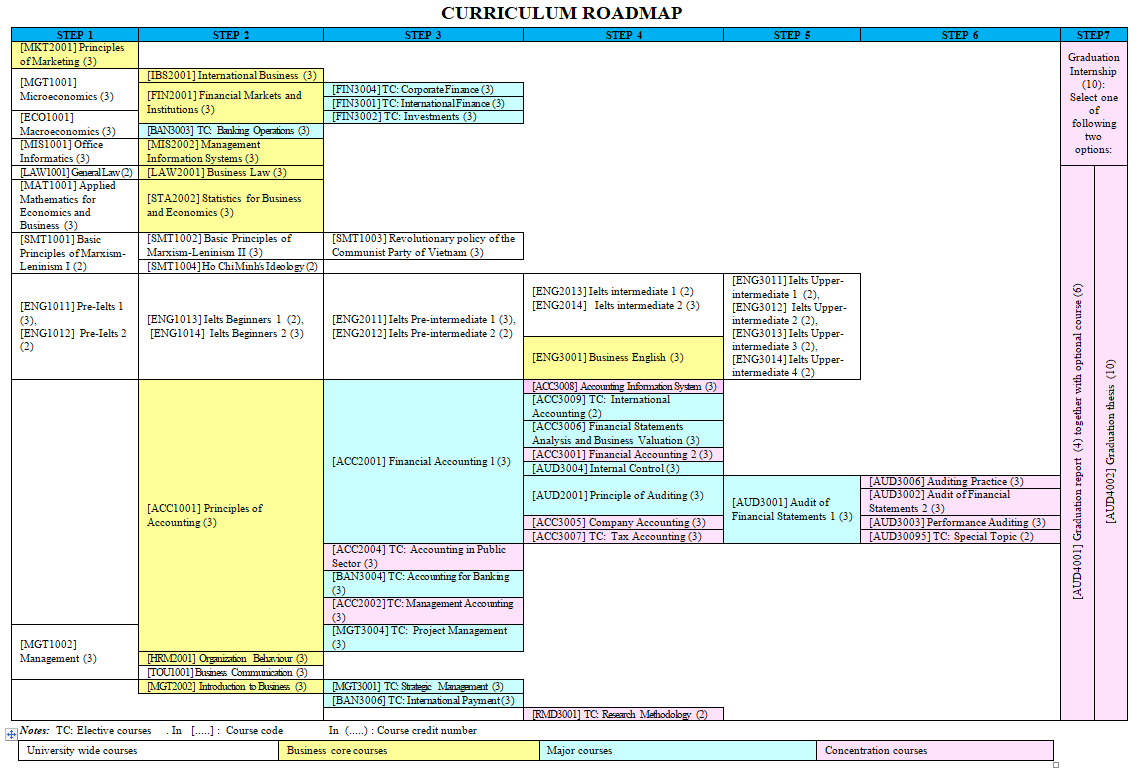

ROADMAP OF AUDITING PROGRAMME

The curriculum of Auditing Programme is clearly demonstrated through the following map:

See more at: Program Specification (Bachelor of Auditing, 2019)

Curriculum structure is divided into 3 knowledge parts, which include both compulsory and optional parts with a number of credits followed:

| No. |

Courses |

Number of credits |

| Compulsory |

Optional |

| I |

General course |

50 |

0 |

| II |

Business course |

30 |

0 |

| III |

Auditing courses |

33 |

20 |

| |

Sub-total |

113 |

20 |

| Total |

|

133 |

Part 1: General courses

General courses: general courses (also called university courses) provide students with basic knowledge of economics, management and law.

|

Course

code

|

Course title

|

Number of periods

|

Credit number

|

|

Theory

|

Practice/

Discussion

|

Total

|

|

SMT1001

|

Basic Principles of Marxism-Leninism I

|

21

|

9

|

30

|

2

|

|

SMT1002

|

Basic Principles of Marxism-Leninism II

|

39

|

6

|

45

|

3

|

|

SMT1003

|

Revolutionary policy of the Communist Party of Vietnam

|

36

|

9

|

45

|

3

|

|

SMT1004

|

Ho Chi Minh's Ideology

|

24

|

6

|

30

|

2

|

|

LAW1001

|

General Law

|

21

|

9

|

30

|

2

|

|

TOU1001

|

Business Communication

|

22

|

23

|

45

|

3

|

|

ENG1011

|

PRE-IELTS 1

|

22

|

23

|

45

|

3

|

|

ENG1012

|

PRE-IELTS 2

|

20

|

10

|

30

|

2

|

|

ENG1013

|

IELTS BEGINNERS 1

|

20

|

25

|

45

|

3

|

|

ENG1014

|

IELTS BEGINNERS 2

|

16

|

14

|

30

|

2

|

|

ENG2011

|

IELTS PRE-INTERMEDIATE 1

|

30

|

15

|

45

|

3

|

|

ENG2012

|

IELTS PRE-INTERMEDIATE 2

|

30

|

0

|

30

|

2

|

|

ENG2013

|

IELTS INTERMEDIATE 1

|

17

|

28

|

45

|

3

|

|

ENG2014

|

IELTS INTERMEDIATE 2

|

7

|

23

|

30

|

2

|

|

MIS1001

|

Office Informatics

|

22

|

23

|

45

|

3

|

|

MAT1001

|

Applied Mathematics for Economics and Business

|

45

|

0

|

45

|

3

|

|

MGT1001

|

Microeconomics

|

36

|

9

|

45

|

3

|

|

ECO1001

|

Macroeconomics

|

38

|

7

|

45

|

3

|

|

MGT1002

|

Management

|

30

|

15

|

45

|

3

|

Part 2: Business courses

Business courses: provide students with business and administration knowledge. These are common courses for all business majors at DUE, create a seamless relationship between accounting programme and the other DUE’s business disciplines such as banking, corporate finance, trade, and so on.

|

Course

code

|

Course title

|

Number of periods

|

Credit number

|

|

Theory

|

Practice/

Discussion

|

Total

|

|

ACC1001

|

Principles of Accounting

|

30

|

15

|

45

|

3

|

|

MKT2001

|

Principles of Marketing

|

34

|

11

|

45

|

3

|

|

MIS2002

|

Management Information Systems

|

30

|

15

|

45

|

3

|

|

HRM2001

|

Organization Behaviour

|

30

|

15

|

45

|

3

|

|

STA2002

|

Statistics for Business and Economics

|

33

|

12

|

45

|

3

|

|

FIN2001

|

Financial Markets and Institutions

|

30

|

15

|

45

|

3

|

|

MGT2002

|

Introduction to Business

|

27

|

18

|

45

|

3

|

|

IBS2001

|

International Business

|

36

|

9

|

45

|

3

|

|

LAW2001

|

Business Law

|

30

|

15

|

45

|

3

|

|

ENG3001

|

Business English

|

12

|

33

|

45

|

3

|

Part 3: Auditing courses

Auditing courses: equip auditing students with specialized knowledge to serve their career orientation after graduation.

|

Course

code

|

Course title

|

Number of periods

|

Credit number

|

|

Theory

|

Practice/

Discussion

|

Total

|

|

ACC2001

|

Financial Accounting l

|

31

|

14

|

45

|

3

|

|

AUD2001

|

Principle of Auditing

|

30

|

15

|

45

|

3

|

|

AUD3001

|

Audit of Financial Statements 1

|

30

|

15

|

45

|

3

|

|

ACC3006

|

Financial Statements Analysis and Business Valuation

|

33

|

12

|

45

|

3

|

|

AUD3004

|

Internal Control

|

34

|

11

|

45

|

3

|

|

Elective courses

Choose at least 5 credits among following elective courses:

|

|

ACC3009

|

International Accounting

|

30

|

15

|

45

|

2

|

|

BAN3003

|

Banking Operations

|

30

|

15

|

45

|

3

|

|

BAN3004

|

Accounting for Banking

|

30

|

15

|

45

|

3

|

|

BAN3006

|

International Payment

|

30

|

15

|

45

|

3

|

|

MGT3001

|

Strategic Management

|

27

|

18

|

45

|

3

|

|

MGT3004

|

Project Management

|

35

|

10

|

45

|

3

|

|

FIN3001

|

International Finance

|

22

|

23

|

45

|

3

|

|

FIN3002

|

Investments

|

23

|

22

|

45

|

3

|

|

FIN3004

|

Corporate Finance

|

21

|

24

|

45

|

3

|

Part 4: Concentration courses

|

Course

code

|

Course title

|

Number of periods

|

Credit number

|

|

Theory

|

Practice/

Discussion

|

Total

|

Compulsory courses

|

|

ACC3001

|

Financial Accounting 2

|

32

|

13

|

45

|

3

|

|

AUD3002

|

Audit of Financial Statements 2

|

12

|

33

|

45

|

3

|

|

ACC3005

|

Company Accounting

|

30

|

15

|

45

|

3

|

|

AUD3003

|

Performance Auditing

|

30

|

15

|

45

|

3

|

|

ACC3008

|

Accounting Information System

|

30

|

15

|

45

|

3

|

|

AUD3006

|

Auditing Practice

|

10

|

35

|

45

|

3

|

|

Elective courses

Choose at least 5 credits among following elective courses:

|

|

ACC2002

|

Management Accounting

|

20

|

25

|

45

|

3

|

|

ACC2004

|

Accounting in Public Sector

|

30

|

15

|

45

|

3

|

|

ACC3007

|

Tax Accounting

|

30

|

15

|

45

|

3

|

|

AUD3095

|

Special Topic

|

0

|

30

|

30

|

2

|

|

RMD3001

|

Research Methodology

|

17

|

13

|

30

|

2

|

Part 5: Graduation intership

|

Course code

|

Course title

|

Number of periods

|

Credit number

|

|

Theory

|

Practice/

Discussion

|

Total

|

|

Option 1

|

|

AUD4001

|

Graduation report

|

0

|

60

|

60

|

4

|

|

Option 2

|

|

AUD4002

|

Graduation thesis

|

0

|

150

|

150

|

10

|

| |

Number of credits |

| No. |

Courses |

Compulsory |

Optional |

| I |

General Courses |

50 |

0 |

| II |

General courses |

30 |

0 |

| III |

Business courses |

33 |

20 |

| Sub-total |

Accounting courses |

113 |

20 |

| Total |

|

133 |

| |

Number of credits |

| No. |

Courses |

Compulsory |

Optional |

| I |

General Courses |

50 |

0 |

| II |

General courses |

30 |

0 |

| III |

Business courses |

33 |

20 |

| Sub-total |

Accounting courses |

113 |

20 |

| Total |

|

133 |

| |

Number of credits |

| No. |

Courses |

Compulsory |

Optional |

| I |

General Courses |

50 |

0 |

| II |

General courses |

30 |

0 |

| III |

Business courses |

33 |

20 |

| Sub-total |

Accounting courses |

113 |

20 |

| Total |

|

133 |

| |

Number of credits |

| No. |

Courses |

Compulsory |

Optional |

| I |

General Courses |

50 |

0 |

| II |

General courses |

30 |

0 |

| III |

Business courses |

33 |

20 |

| Sub-total |

Accounting courses |

113 |

20 |

| Total |

|

133 |

|

Number of credits |

| No. |

Courses |

Compulsory |

Optional |

| I |

General Courses |

50 |

0 |

| II |

General courses |

30 |

0 |

| III |

Business courses |

33 |

20 |

| Sub-total |

Accounting courses |

113 |

20 |

| Total |

|

133 |